5 February, 2025

U.S. Customs and Border Protection (CBP) Policy Update Effective February 4, 2025, and Service Adjustments Announcement

CBP has announced that starting February 4, 2025 (EST), all imports originating from China (including Hong Kong) will be subject to an additional 10% duty. The existing de minimis exemption for goods under USD 800 (T86) is canceled, and prior 301, 201, and 232 tariffs remain in place. This will significantly increase customs clearance costs and may cause shipment delays. Our company will adjust its current services accordingly, and we urge you to review the details below and prepare in advance.

I. Effective Date of the New Policy

- Effective Date: 12:01 AM (EST), February 4, 2025

Starting at this time, all shipments exported from China (including Hong Kong) to the United States are subject to the new tariff policy.

II. Main Policy Changes & Key Points

-

Cancellation of de minimis Exemption

- The previous duty-free clearance process for goods under USD 800 (T86, etc.) no longer applies.

- Even if the value is below USD 800, goods must be properly declared and duties paid.

-

Additional 10% Duty

- In line with the latest Executive Order and Federal Register, all goods originating from China (including Hong Kong) will face an extra 10% tariff on top of existing rates (301, 201, 232, etc.).

- As per the announcement, product descriptions, declared values, and quantities must meet CBP requirements, and goods are no longer eligible for the de minimis exemption.

-

Stricter Customs Compliance

- CBP has intensified oversight of imports from China (including Hong Kong); accurate details such as HS Code, product name, usage, material, weight, and quantity are mandatory.

- Please update and confirm the compliance information of your items to avoid customs delays, seizures, or penalties.

Example for Reference:

- Women’s woven pants (HS Code: 6204690310)

- Base duty rate: 28.6%

- Section 301 additional duty: 7.5%

- Section 0204 additional duty: 10%

- Total Duty Rate: 46.1%

III. Our Service & Fee Adjustments

-

Additional Customs Handling Fee

- Effective 9:00 AM (Beijing Time), February 5, 2025, an additional customs handling fee of HKD 22 per shipment will be charged for all packages sent from China (including Hong Kong) to the United States.

-

Duty Prepayment

- For shipments signed in after 9:00 AM (Beijing Time), February 5, 2025, we will collect a 30% duty deposit in advance, to be settled on a “refund or supplement” basis according to the actual amount charged by U.S. Customs.

-

Temporary Suspension of Cosmetic Product Line

- Shipments via the MUZXR and MUZXRF2P cosmetic product lines to the U.S. will be temporarily suspended.

IV. Recommendations & Important Notes

-

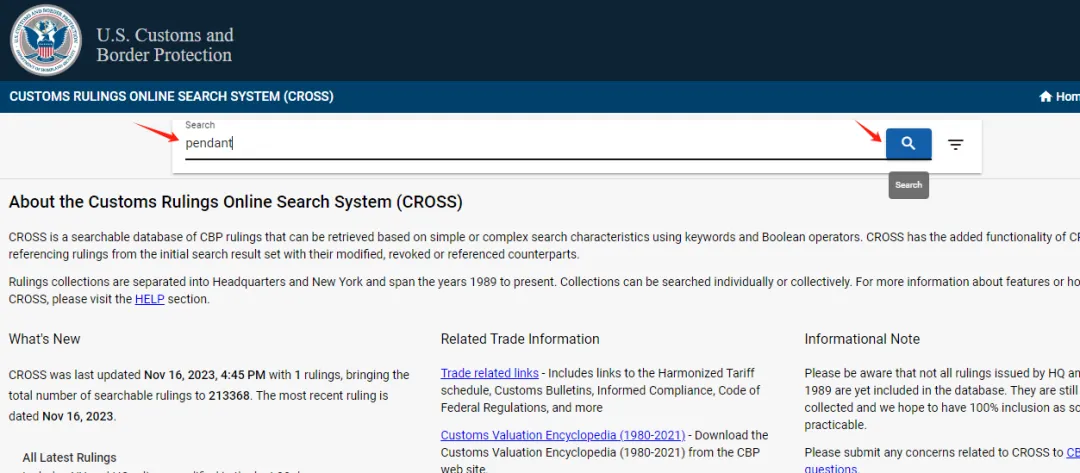

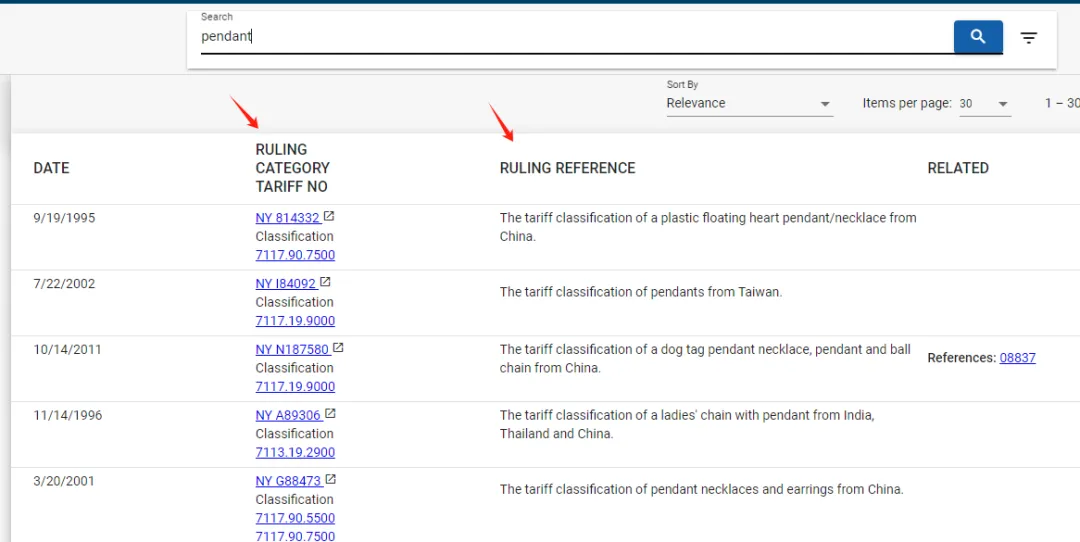

Duty Rate Checks

- Before shipping, please use the U.S. Customs tariff website or the official CBP website to look up HS Codes and duty rates. Providing the correct HS Code is essential to ensure proper classification.

-

Advance Preparation & Customer Communication

- Please adjust pricing, inventory, and shipping timelines accordingly, and inform buyers of possible delays or additional fees.

-

Further Updates

- CBP may release additional technical notices through CSMS or other official channels. We will continue to monitor any updates and notify you promptly.

If you have any questions regarding the policy or our service adjustments, please reach out to your account manager or our customer service team. We remain committed to providing you with the best possible support under these new regulations.